The Big Banks Laughed

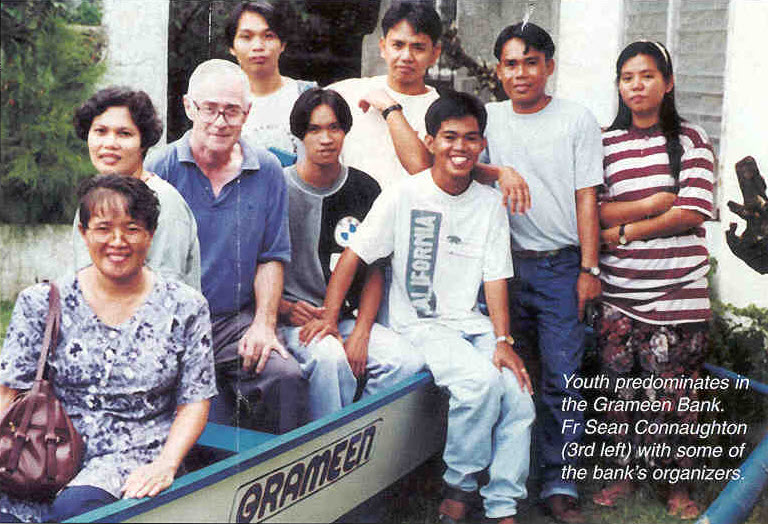

For 40 years Fr. Sean Cannaughton has grappled with the problem of poverty. Then one day he heard of the Grameen Bank. In an interview he tells us about it here.

Q. Who was the founder of the Grameen Bank?

It was founded by Professor Muhammad Yunus. He was the head of the Department of Economics in Chitagong University in Bangladesh. In the Bengali language the word grameen means rural village. This village bank differs radically from most banks we know. For Professor Yunus, the Grameen is a bank that comes to the people. He retained the name ‘bank’ in the hope of transforming the meaning of the term.

Q. What led him to set up the bank?

A. He began to see his university career like life in the cinema. The film ended once you got outside the gate. When class was over he walked home through streets full destitute people. The contradictions came to a head during the famine in Bangladesh in 1974 when he experienced the inability of the academic world to do anything. He began to travel throughout the country asking questions and observing what was happening. During that time he worked out the basic framework of what became the Grameen Bank.

Q. How did he translate his ideas into practice?

A. He began with a woman selling bamboo stools on a street corner. She bought the materials from a local store and then sold the stools to the store to pay her debts. She was left with almost nothing. It was slave labor. He lent her the money for the next purchase of raw material on condition she paid him back. She prepaid the loan on time. He persuaded the university students to put up about £1,000. All was loaned and returned. Then the university put up a bigger sum which was loaned and returned. When he asked some banks to make loans available to the poor they laughed at him. So he decided to found a bank himself. The membership in Bangladesh has risen from a million in 1991 to over three million today and has improved the lives of 15 million people.

Q. How did you get involved in the Grameen Bank?

A. During the 1970’s I was chaplain to a number of universities in Manila. As part of the student summer projects we used to run seminars training people how to set up livelihood cooperatives. We set up 26, many of which still flourished today. But I noticed that within six months 30% of the participants were forced to leave for lack of money. They could not keep up payments of the fixed deposits and saving deposit, or put up the necessary collateral required by the cooperative. (In simple terms the collateral is the guarantee behind the loan. If the borrower failed to pay up, the co-op had a right to claim his/her radio, for example.) In 1989 while doing some studies in the University of Sussex, I met people from Bangladesh who spoke of the Grameen Bank, a system that seemed to be just the kind of thing very poor people need.

Q. So you changed from promoting cooperatives to the Grameen Bank?

A. Yes, with the result that in many areas where we formerly set up co-ops there are now much more successful Grameen Banks. On my return to the Philippines in 1989 I talked the idea with other people, university professors, businessman, a forestry expert. We decided to set up the Grameen in Jala Jala, the area where I then worked. By Lucky coincidence Professor Yunus visited the Philippines and also visited our parish to give encouragement. By 1993 Jala Jala had ten centers and 300 hundred members. I was also able to spend a month in Bangladesh observing the system.

Q. How do bank organizers present their objectives?

A. Basically as agents of change. As the movement grows we hope to change the attitude of commercial banks. When we asked the First National Saving Bank recently for the loans they offered it at 28% interest – as bad as the money lenders. Funds given to the Filipino government by other countries for the alleviation of poverty are available to us at 12% per annum provided that 95% of the capital is repaid annually. This is too much for the people who most need it.

Q. How do you go about setting up a bank group?

A. The condition for initial entry to a group is that the applicant must be poor and be committed to the observance of the rules such as repayment of loans and attendance at weekly meetings. Maybe 100 people will turn up for a fist meeting. Then they are told that they will be divided up into groups of five (who know each other very well) and if one fails to pay the weekly installment the other four will have to cover it. About half lose interest.

In the following six training sessions the basic principles are studied. These are designed for our local situations and cover. Areas like work-discipline, home hygiene and education of children. At the end of the sessions there is a formal event. Participants dress up and invite their friends to the final oral exam called the Group Recognition Test, where they are individually questioned about the 16 basic principles. They worked hard in order to put up a good show. If one of the groups does not pass their test all must start all over again. A key objective in the initial course is to teach respect for money. Two participants were forced to get rid of their gambling machine before they were allowed to join because it represented of lack of respect.

The next step is for the group-of-five to determine their projects. One might say “I am going to raise chickens.” Another “I am going to make nets” and so on. The group then discusses the individual projects. It might be objected “You don’t know enough about chickens, do something else.” The others are aware that they will have to pay for the irresponsibility of a member. A Fundamental Grameen principle is that one cannot, for example, seize the gas cooker of a woman who makes her living by cooking with it, even if she cannot pay her installment. The group has an Emergency Fund, into which everyone must pay something, to help with, for example, a sickness. There is another Group Funds to help with other seasonal needs like school tuition.

Projects are approved by the group and then by the branch office. Money is granted within a week of approval. The group-of-five then come to the office, make a promise, and receive the money. They are given two weeks to set up business. Subsequently, at all levels, a check is left on loan utilization. People who have been eliminated from the program for misuse of funds often reapply later and are accepted. The second time around things generally work out. Group pressures ensures a high level of responsibility. The first year there are often failures and fund abusers. After that almost all are filtered out.

Q. Does anyone ever say ‘That is peculiar sort of job for a priest to be involved in’?

A. It was the dire poverty of the places I lived in that brought me into this kind of work. Even today the daily wage of many of the people we work with wouldn’t buy a kilo of fish. We stared the co-op in the Manila squatter settlement of Tondo with 200 pesos. To date it has lent 35 million pesos and improved the lives of many poor people. Its 900 members are a core of the local economy. In 1997 the mayor of Manila gave Tondo an award for being the city’s outstanding co-op. A bit of capital put into the hands of the poor can transform both individuals and community in which they live. Things that take place ‘inside’ the church are obviously important. But if people are literally dying of poverty and scourge with delinquency something more is called for. I believe that if justice is not being promoted the Gospel of Jesus of Nazareth is not being preached.

(The Far East)